Quantitative Easing (QE) Explained: Central Bank Tool for Growth (Part 2)

THE BANK OF ENGLAND (BOE) QUANTITATIVE EASING POLICY

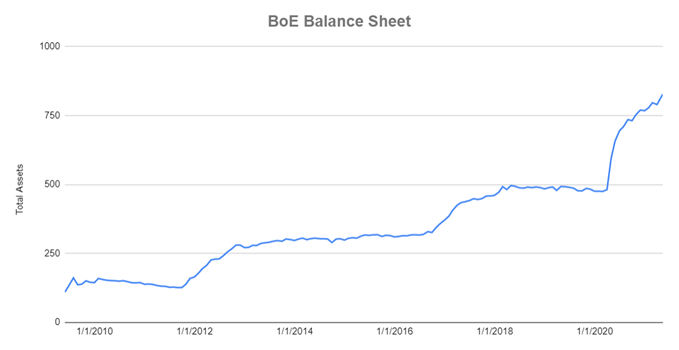

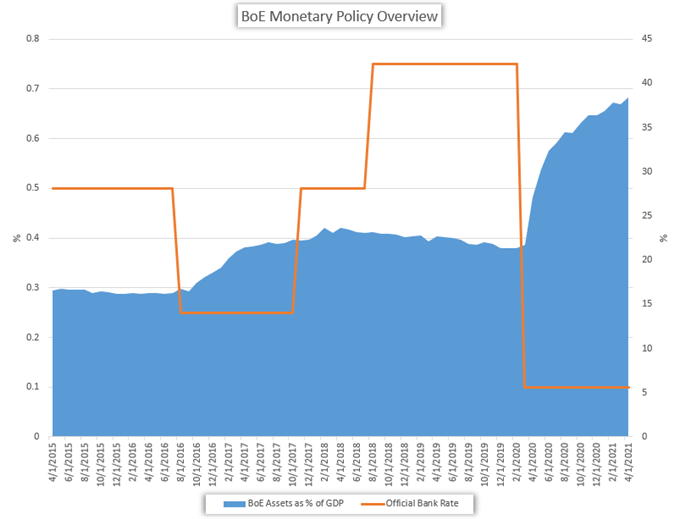

Pipscollector.com - Like the previously mentioned central banks, the BOE has amassed large sums of local government bonds (GILTs) and corporate bonds through its own quantitative easing. The policy was pursued to bolster the UK’s economy during the height of the global recession which would eventually carry over to the added risk of political risks from a Scottish Referendum vote, General Election and eventually the Brexit. At the same time, the bank has increased its overnight lending rate slowly.

Source: Bloomberg

In contrast to its American and Japanese counterparts, the overall holdings of the UK’s central bank are significantly smaller. When compared to national GDP, the Bank of England’s holdings amount to a mere 5.7% in early 2019, paling in comparison to Japan’s holdings that equate to more than 100% of GDP. The relatively small holdings may allow the bank to act more effectively in the future as the diminishing returns of QE have yet to take hold.

Source: Bloomberg

At present, the efficacy of the BOE’s quantitative easing strategy appears to top that of the BOJ and fall inline with that of the Federal Reserve. As the uncertainties of Brexit persist, the bank may decide to maintain its safety net or perhaps even further its monetary policy measures. That being said, the bank would remain far less committed to quantitative easing than its neighbor, the European Central Bank.

THE EUROPEAN CENTRAL BANK (ECB) QUANTITATIVE EASING POLICY

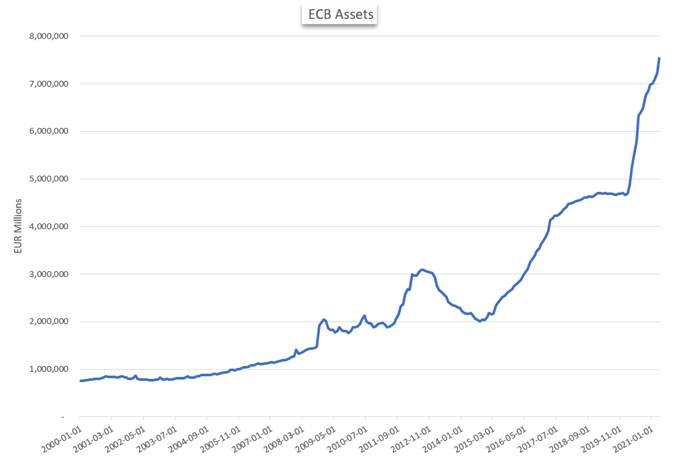

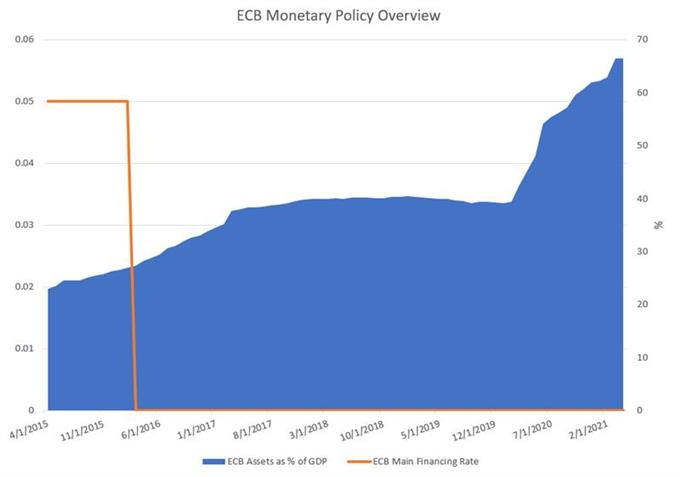

The ECB is another major central bank that has pursued quantitative easing as an expansionary tool – though its foray into the now conventional QE came significantly latter than the Fed’s. In its most recent round of easing, the European Central Bank spent nearly $3 trillion buying government bonds and corporate debt, along with asset-backed securities and covered bonds.

The purchases were conducted from March 2015 to December 2018 in an effort to avoid sub-zero inflation from plaguing the European bloc which was still in recovery from the dual scourge of the global recession and then the Eurozone Debt Crisis. According to Reuters, the purchases came at a pace of 1.3 million Euros a minute, equating to 7,600 Euros per person in the bloc.

Source: Bloomberg

Like Japan, the ECB’s easing rounds proved rather ineffective. In early 2019, the bank announced another round of easing through targeted long-term refinancing operations or TLTROs, just months after the end of its opened-ended QE program and as interest rates remain at 0. TLTROs provide an injection of low interest rate funding to banks in the Eurozone in an effort to provide greater bank liquidity and lower sovereign debt yields. The loans carry a maturity of one to four years.

Source: Bloomberg

TLTROs aim to stabilize the balance sheet of private banks and their liquidity ratio. A stronger liquidity ratio allows the bank to lend more readily which in-turn, pushes down interest rates and should allow for inflation. However, years of monetary stimulus can see diminishing returns and have negative implications.

NEGATIVE EFFECTS OF QE: BALANCE SHEET USE AND DIMINISHING RETURNS

While QE proved fruitful for the Federal Reserve and the United States, the monetary policy tool has proved less effective for the central banks of Japan and Europe and has even contributed some negative consequences. For the Japanese economy, years of expansionary policy has resulted in deflation and the bank’s balance sheet now carries more value than the GDP of the country.

Further, its large share of ownership of the ETF, JRIET and government bond market may put it at heightened risk in the eventuality of an economic downturn. Despite numerous rounds of stimulus and negative interest rates, economic growth has failed to take hold and the Japanese central bank is wading into unknown monetary policy territory.

Similarly, the ECB has seen its own form of quantitative easing exert less influence over the European economy as inflation and growth remain muted in the bloc.

THE IMPACT OF QUANTITATIVE EASING ON CURRENCIES

Fundamentally, the use of quantitative easing increases the supply of a currency. According to the commanding principles of supply and demand, such a change should result in the price of that currency decreasing. However, as currencies are traded in pairs, the resulting weakness in one currency is relative to its counterpart.

With the current monetary policy climate trending toward flush supply and dovish tones, few currencies herald absolute strength. That said, strength has recently been garnered through an almost best-of-the-rest mentality in which a dovish shift from one central bank is followed shortly thereafter with dovishness from another bank. Such subtle competitive policies can turn more aggressive, resulting in what is termed a ‘currency war’.

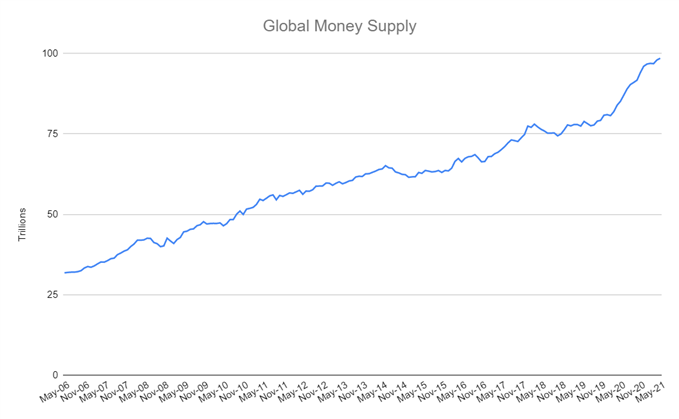

Source: Bloomberg

Consequently, the global supply of money has ballooned while the relative value of currencies remains in flux. In the current monetary policy climate, differences in approach have largely become a comparison in dovishness. Among the major central banks, few stand on the hawkish side of policy and fewer still have plans to raise their central interest rate. Instead, officials have resorted to rounds of capital injection as quantitative easing appears to be gaining popularity as a monetary policy tool – though whether it remains as a permanent one remains to be seen.