Forex technical analysis and forecast: Majors, equities and commodities

Pipscollector.comPipscollector.com - Forex market forecast and technical analysis: Major pairs, stocks and commodities

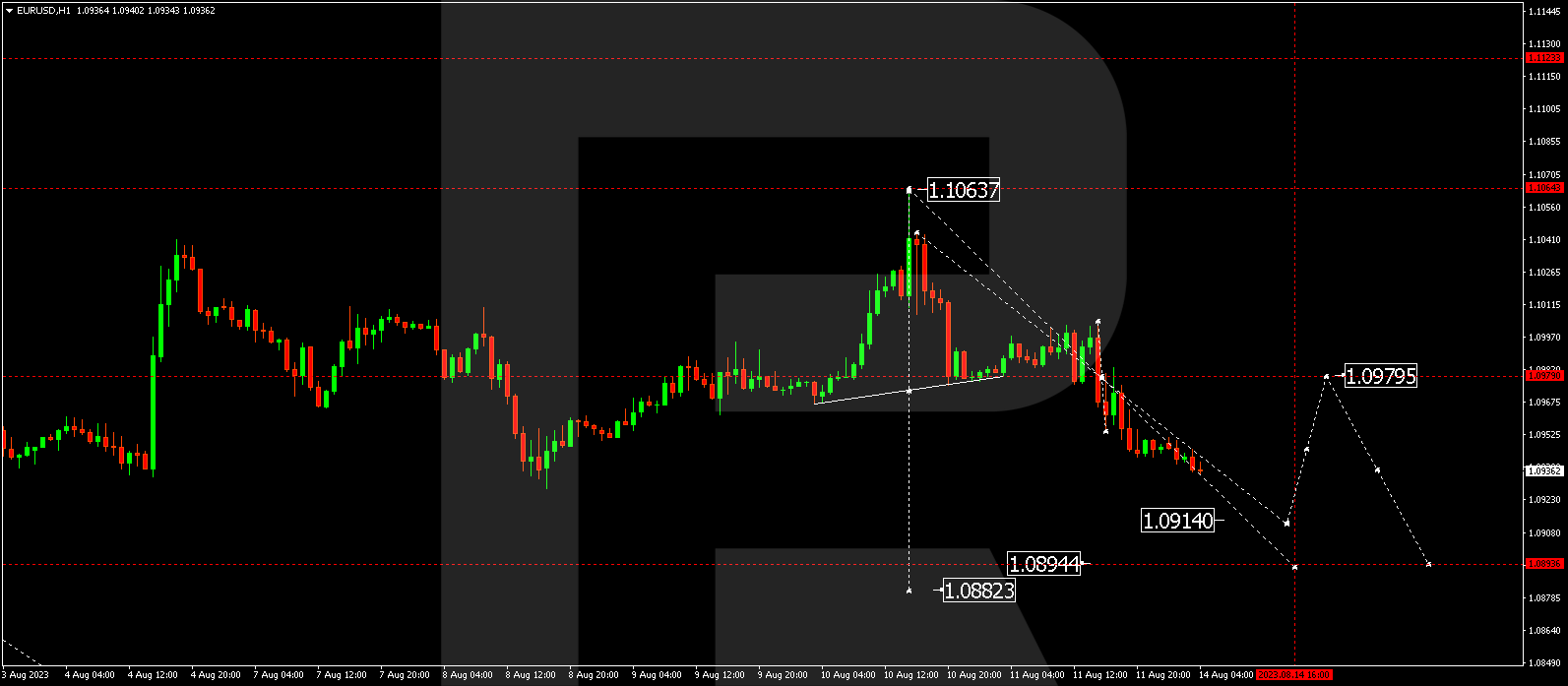

EUR/USD, “Euro vs US Dollar”

EUR/USD has formed a consolidation range around 1.0980 and, breaking it downwards, continues developing a structure of decline to 1.0914. After the price reaches this level, a link of correction to 1.0980 is not excluded (with a test from below). Next, a decline to 1.0890 is expected, from where the trend might continue to 1.0880.

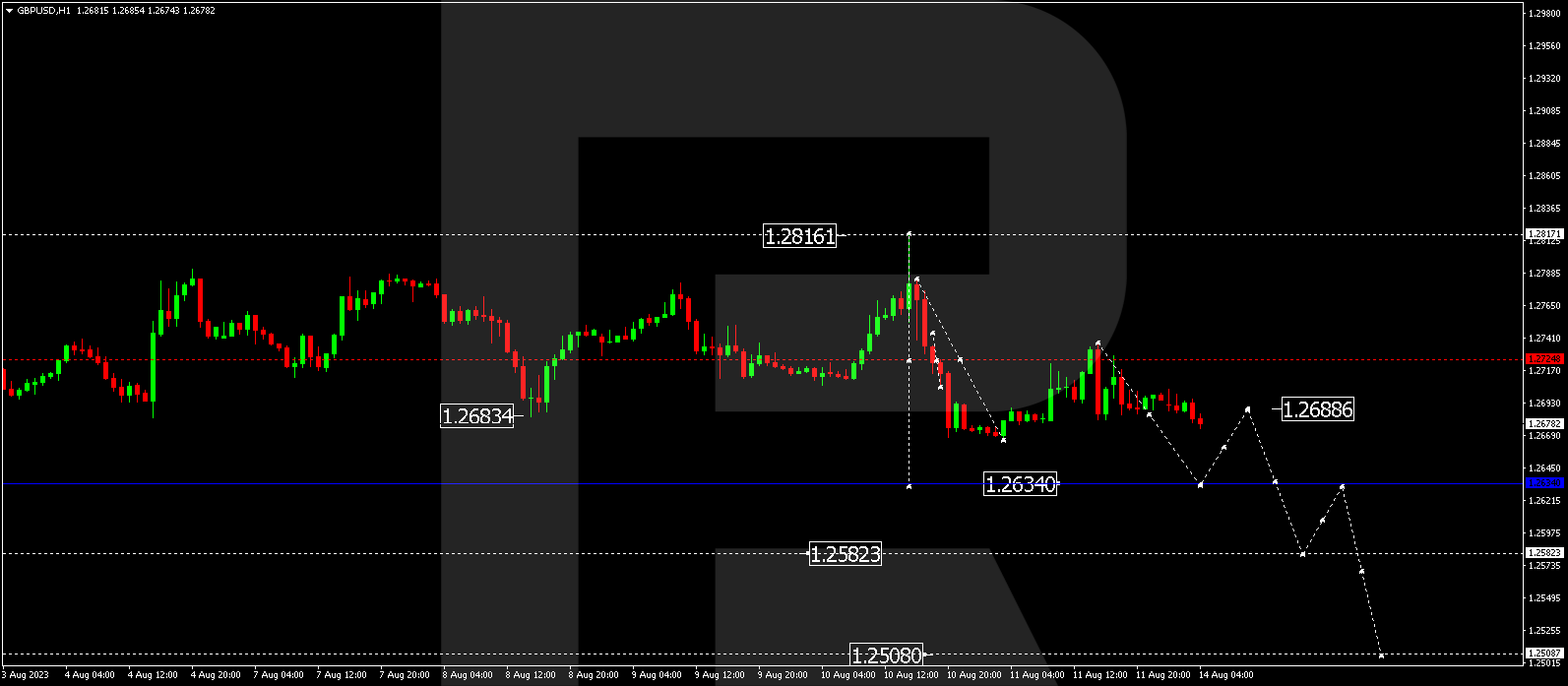

GBP/USD, “Great Britain Pound vs US Dollar”

GBP/USD has broken 1.2688 downwards and continues developing a structure of decline to 1.2634. After the price reaches this level, a link of growth to 1.2688 is not excluded (a test from below). Next, a decline to 1.2582 could follow, from where the trend might continue to 1.2500.

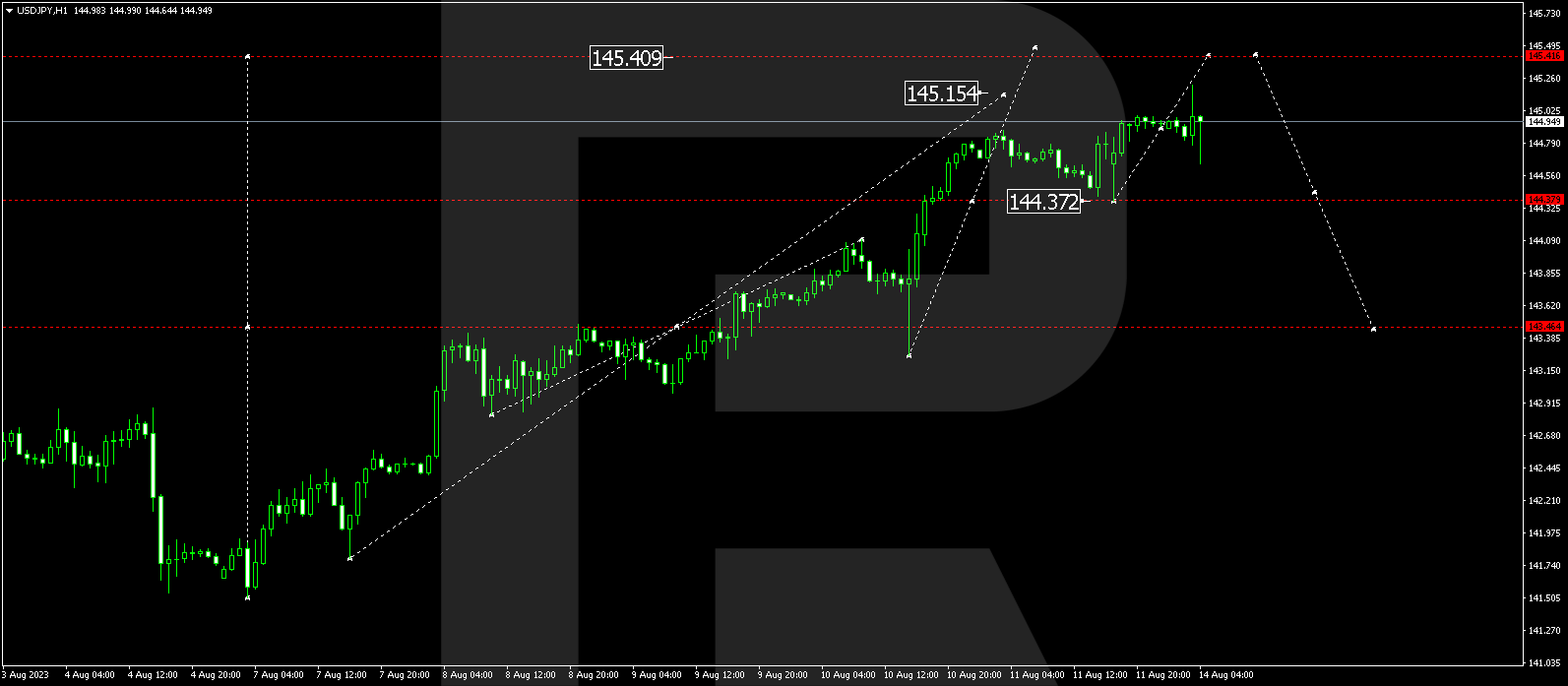

USD/JPY, “US Dollar vs Japanese Yen”

USD/JPY has completed a wave of growth to 145.15. Today the market is forming a consolidation range under this level. Breaking it downwards, the price could correct to 144.40. And breaking this level downwards as well, the correction could continue to 143.44. Escaping the range upwards, the price could open the potential for a rise to 145.45. Next, a decline to 144.40 might follow.

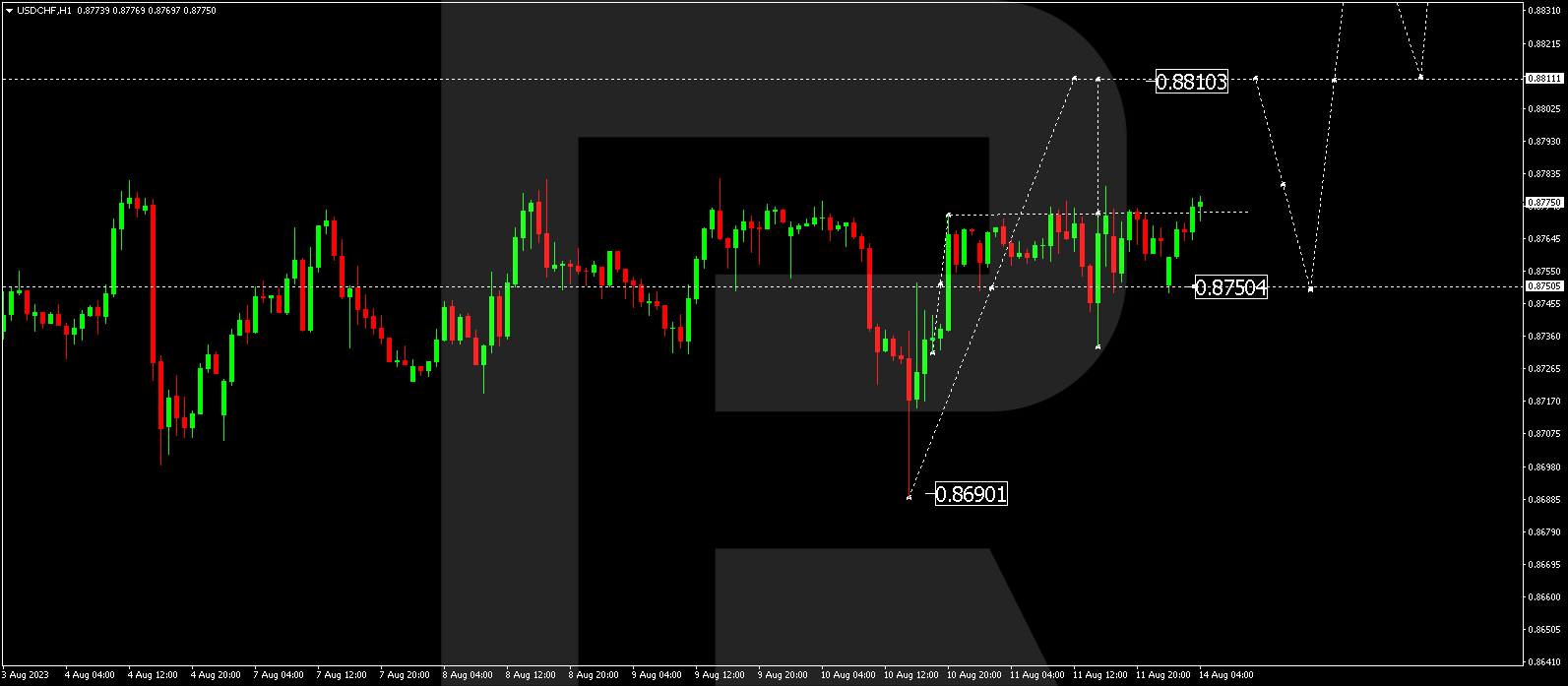

USD/CHF, “US Dollar vs Swiss Franc”

USD/CHF continues developing a wave of growth to 0.8810. This is the first target. After the price reaches this level, after the price reaches this level, a link of correction to 0.8750 is not excluded. As soon as the correction is over, a new wave of growth to 0.8870 is expected. This is a local target.

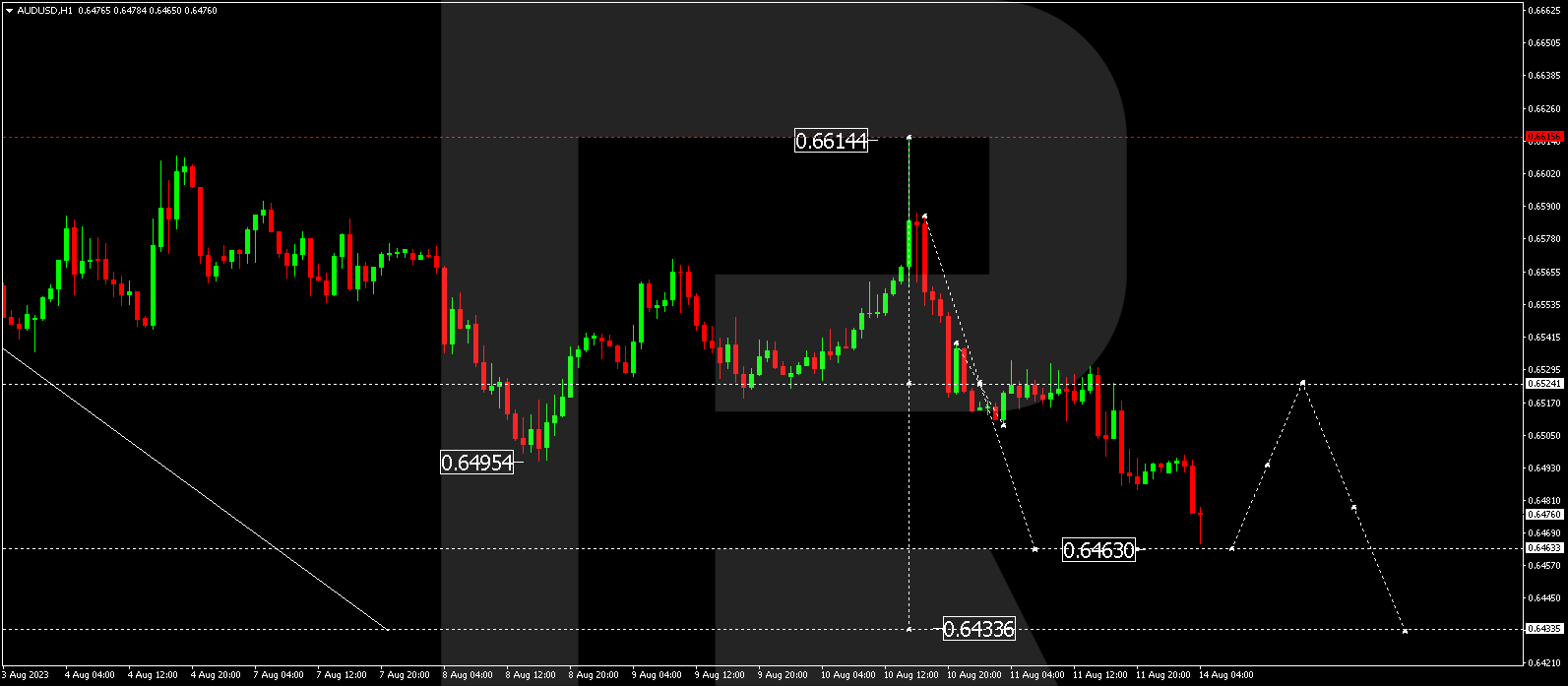

AUD/USD, “Australian Dollar vs US Dollar”

AUD/USD has completed a new structure of decline to 0.6464. Upon reaching this level, the market started developing a consolidation range. With an escape from the range upwards, a link of correction to 0.6520 is not excluded, followed by a decline to 0.6433. With an escape from the range downwards, the potential for a decline to 0.6433 could open, followed by a correction to 0.6520.

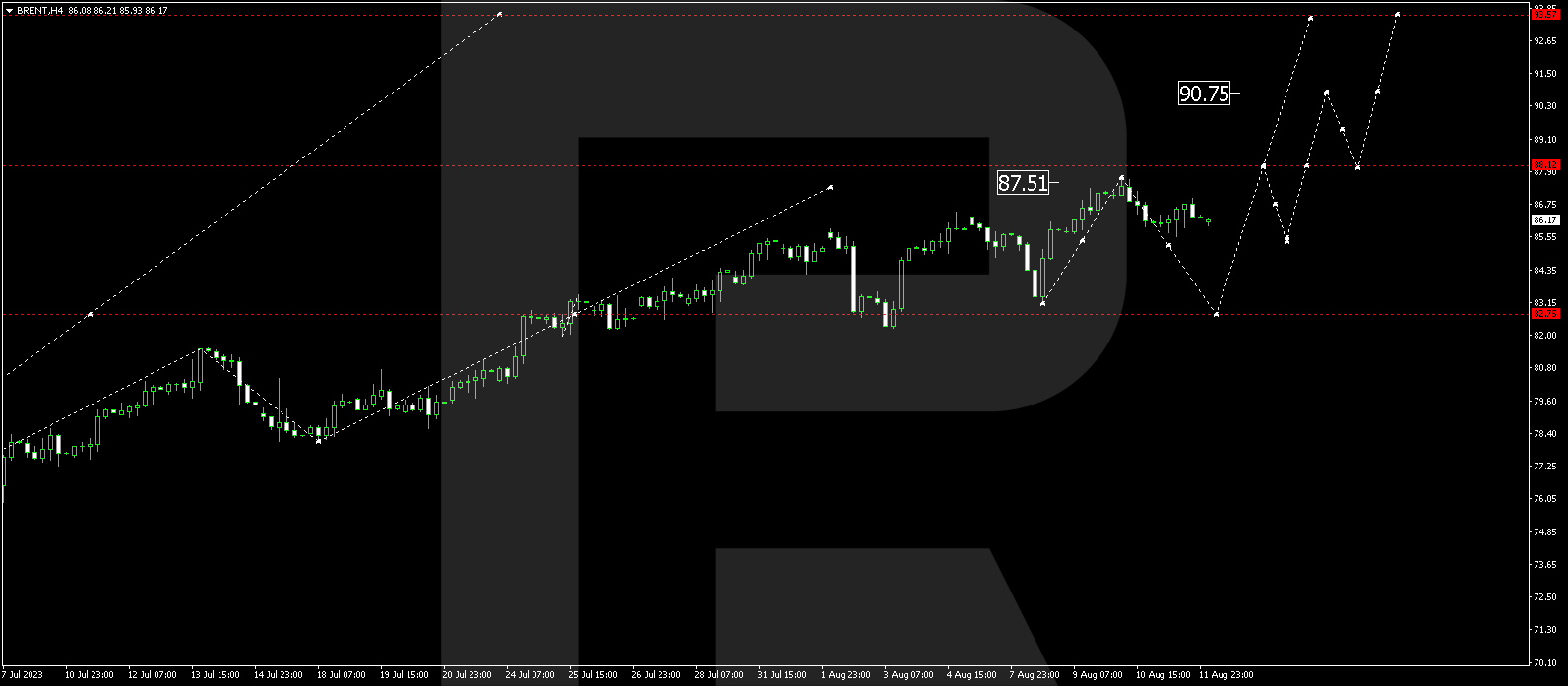

Brent

Brent has reached the local target of a growing wave at 87.71. A consolidation range might develop under this mark today. With an escape from the range downwards, a link of correction to 82.75 is not excluded. After it is over, a new structure of growth to 90.75 could form, from where the trend might continue to 93.57.

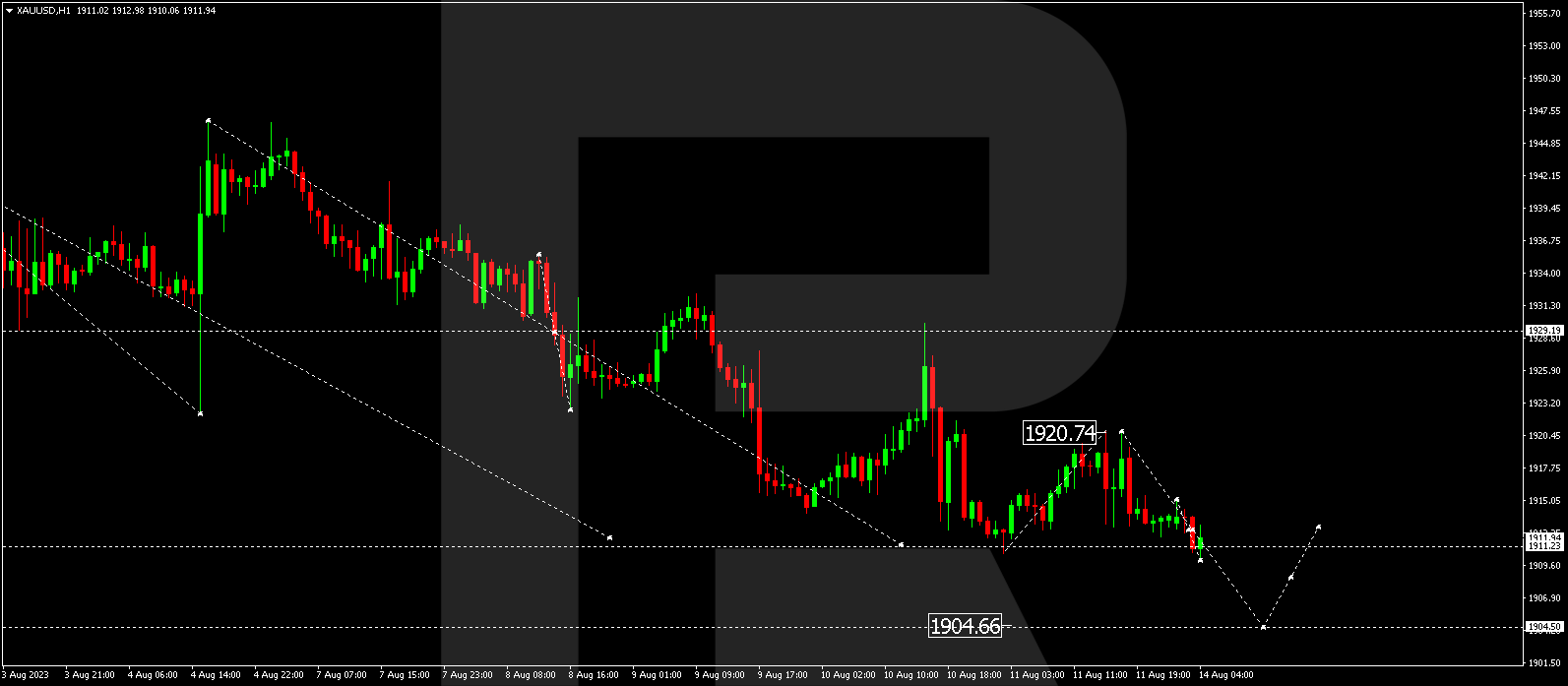

XAU/USD, “Gold vs US Dollar”

Gold has completed a structure of decline to 1910.06. Today the market is forming a narrow consolidation range above this level. It is expected to escape the range downwards and extend the wave of decline to 1904.66. After the price reaches this level, a link of correction to 1912.12 is not excluded, followed by a decline to 1895.55.

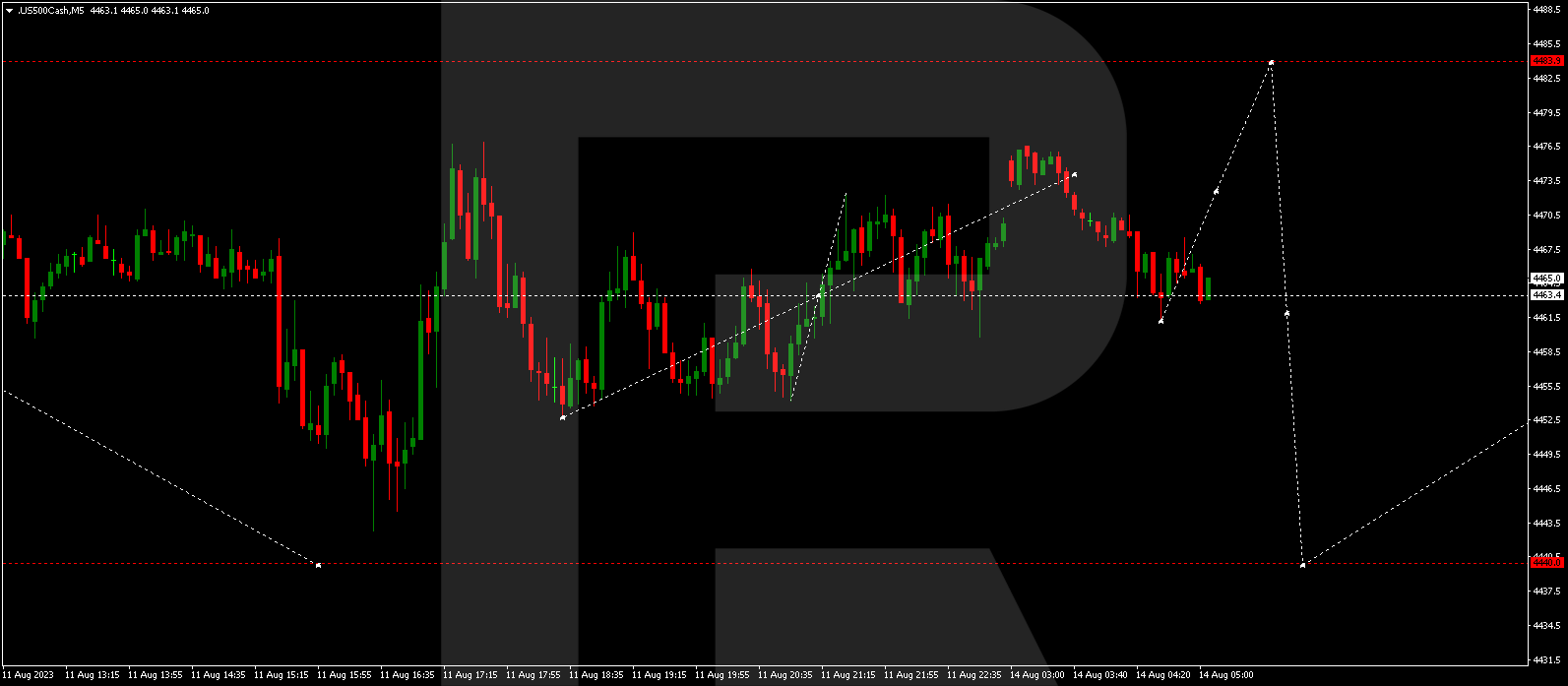

S&P 500

The stock index completed a wave of correction to 4450.7. Next, the market started developing a new structure of growth to 4483.5. After the price reaches this level, a new wave of decline to 4440.0 is expected.

- Pipscollector -