Gold Price Forecast: XAU/USD recovery needs acceptance from $1,975 and central banks – Confluence Detector

- Gold Price rebounds from one-week low, snaps four-day losing streak amid risk-on mood.

- Headlines from China, concerns about policy pivot at major central banks favor sentiment and propel XAU/USD price.

- Anxiety ahead of key central bank events, $1,975 resistance confluence prod Gold buyers.

- Mid-tier United States data may entertain XAU/USD traders but Fed, ECB plays are crucial to watch for clear directions.

Optimism and information from China support gold prices

Pipscollector.com - Gold Price (XAU/USD) reverses from the lowest level in two weeks, snapping a four-day downtrend, as headlines about China stimulus and central banks propel sentiment and the XAU/USD price. In doing so, the XAU/USD traders portray the market’s cautious optimism ahead of this week’s top-tier data/events.

That said, headlines fueling hopes of China stimulus and bank intervention from Beijing seem to bolster the optimism in the Asia-Pacific zone. However, mixed concerns about the previously released PMIs and central bank actions seem to prod the XAU/USD bulls.

US averages affect XAU/USD trading

Amid these plays, the S&P500 Futures remain sidelined near 4,580, struggling to extend the previous day’s recovery, whereas the US 10-year and two-year Treasury bond yields retreat from the highest levels in two weeks to 3.86% and 4.84% in that order. It should be noted that the US Dollar’s retreat from a fortnight high also portrays the market’s optimism and propel the Gold Price.

Looking forward, US CB Consumer Confidence for July, expected 112.10 versus 109.70 prior, will direct intraday moves of the Gold Price. However, major attention will be given to the monetary policy meeting of the Fed and the ECB, as well as clues for the same.

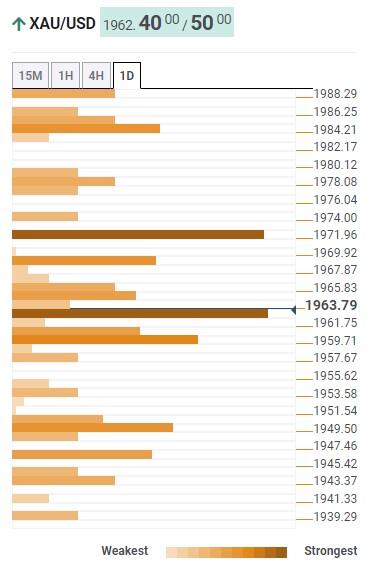

Gold Price: Key levels to watch

Our Technical Confluence indicator suggests the Gold Price inaction around the $1,964 support-turned-resistance comprising the 100-DMA and a convergence of the Fibonacci 61.8% on one-day and one-week.

The XAU/USD’s ability to cross the $1,964 hurdle joins the upbeat sentiment and the US Dollar’s retreat to keep the buyers hopeful of poking the $1,975 resistance confluence including Fibonacci 78.6% on one-week and Pivot Point one-month R1.

Following that, the previous monthly high and Pivot Point one-week R1 will act as the last defense of the XAU/USD bears near $1,985.

Meanwhile, a downside break of the $1,964 resistance-turned-support (stated above), can quickly fetch the Gold Price toward $1,960 comprising Fibonacci 38.2% on one-day and 10-DMA.

Gold price key support and resistance levels

However, the XAU/USD weakness past $1,960 could convince the bears to attack the $1,950 support encompassing the lower band of the Bollinger on the four-hour, Fibonacci 61.8% on one-month and Pivot Point one-day S1.

Overall, the Gold Price regains upside momentum but bulls need validation from $1,975.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.

- Pipscollector -