Top 8 Forex Trading Strategies and their Pros and Cons (part 2)

Pipscollector.com - Top 8 forex trading strategies being used by millions of traders globally.

See more: Pros and cons of the top 8 forex trading strategies (Part 1)

3. TREND TRADING STRATEGY

Trend trading is a simple forex strategy used by many traders of all experience levels. Trend trading attempts to yield positive returns by exploiting a markets directional momentum.

Length of trade:

Trend trading generally takes place over the medium to long-term time horizon as trends themselves fluctuate in length. As with price action, multiple time frame analysis can be adopted in trend trading.

Entry/Exit points:

Entry points are usually designated by an oscillator (RSI, CCI etc) and exit points are calculated based on a positive risk-reward ratio. Using stop level distances, traders can either equal that distance or exceed it to maintain a positive risk-reward ratio e.g. If the stop level was placed 50 pips away, the take profit level wold be set at 50 pips or more away from the entry point.

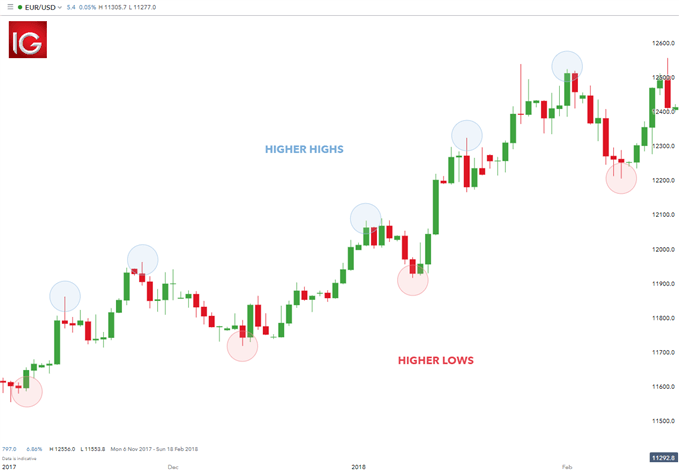

Example 2: Identifying the Trend

In the simple example above, EUR/USD exhibits an upward trend validated by higher highs and higher lows. The opposite would be true for a downward trend.

EUR/USD Trading the Trend

When you see a strong trend in the market, trade it in the direction of the trend. For example, the strong uptrend in EUR/USD above.

Using the (CCI) as a tool to time entries, notice how each time CCI dipped below -100 (highlighted in blue), prices responded with a rally. Not all trades will work out this way, but because the trend is being followed, each dip caused more buyers to come into the market and push prices higher. In conclusion, identifying a strong trend is important for a fruitful trend trading strategy.

Trend trading can be reasonably labour intensive with many variables to consider. The list of pros and cons may assist you in identifying if trend trading is for you.

Pros:

- Substantial number of trading opportunities

- Favourable risk-to reward ratio

Cons:

- Requires lengthy periods of time investment

- Entails strong appreciation of technical analysis

4. POSITION TRADING

Position trading is a long-term strategy primarily focused on fundamental factors however, technical methods can be used such as Elliot Wave Theory. Smaller more minor market fluctuations are not considered in this strategy as they do not affect the broader market picture. This strategy can be employed on all markets from stocks to forex.

Length of trade:

As mentioned above, position trades have a long-term outlook (weeks, months or even years!) reserved for the more persevering trader. Understanding how economic factors affect markets or thorough technical predispositions, is essential in forecasting trade ideas.

Entry/Exit points:

Key levels on longer time frame charts (weekly/monthly) hold valuable information for position traders due to the comprehensive view of the market. Entry and exit points can be judged using technical analysis as per the other strategies.

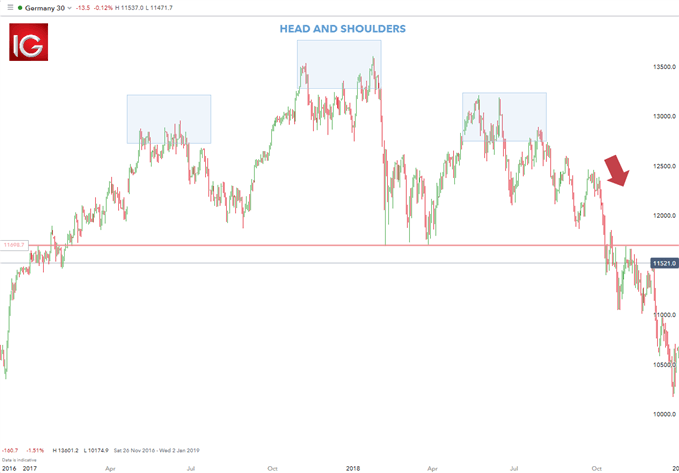

Example 3: Germany 40 (DAX) Position Trading

The Germany 40 chart above depicts an approximate two year head and shoulders pattern, which aligns with a probable fall below the neckline (horizontal red line) subsequent to the right-hand shoulder. In this selected example, the downward fall of the Germany 30 played out as planned technically as well as fundamentally. Towards the end of 2018, Germany went through a technical recession along with the US/China trade war hurting the automotive industry. Brexit negotiations did not help matters as the possibility of the UK leaving the EU would most likely negatively impact the German economy as well. In this case, understanding technical patterns as well as having strong fundamental foundations allowed for combining technical and fundamental analysis to structure a strong trade idea.

List of Pros and Cons based on your goals as a trader and how much resources you have.

Pros:

- Requires minimal time investment

- Highly positive risk-to reward ratio

Cons:

- Very few trading opportunities

- Entails strong appreciation of technical and fundamental analysis

5. DAY TRADING STRATEGY

Day trading is a strategy designed to trade financial instruments within the same trading day. That is, all positions are closed before market close. This can be a single trade or multiple trades throughout the day.

Length of trade:

Trade times range from very short-term (matter of minutes) or short-term (hours), as long as the trade is opened and closed within the trading day.

Entry/Exit points:

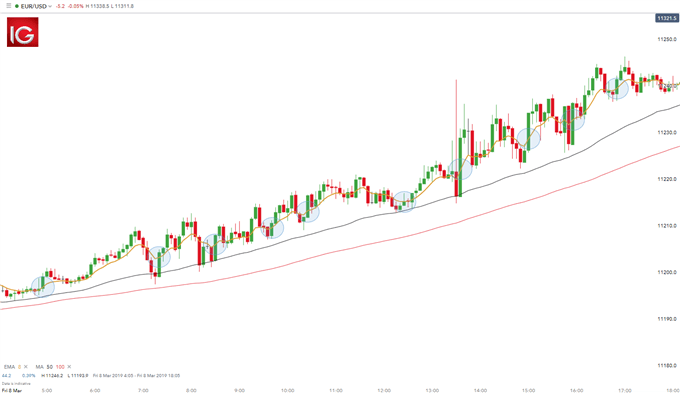

Traders in the example below will look to enter positions at the when the price breaks through the 8 period EMA in the direction of the trend (blue circle) and exit using a 1:1 risk-reward ratio.

Example 4: EUR/USD Day Trading

The chart above shows a representative day trading setup using moving averages to identify the trend which is long in this case as the price is above the MA lines (red and black). Entry positions are highlighted in blue with stop levels placed at the previous price break. Take profit levels will equate to the stop distance in the direction of the trend.

The pros and cons listed below should be considered before pursuing this strategy. Day trading involves much time and effort for little reward, as seen from the EUR/USD example above.

Pros:

- Substantial number of trading opportunities

- Median risk-to reward ratio

Cons:

- Requires lengthy periods of time investment

- Entails strong appreciation of technical analysis

Read more articles in the Educational Content category to update the latest forex knowledge from Pipscollector and continue to Part 3.

- Pipscollector -